Assessing the Stock Market's Risk Amidst Soaring Jobs and Wages, Warns Fund Manager

Cole Smead, CEO of Smead Capital Management, expresses concern about the current state of the U.S. stock market, deeming it “very dangerous.” He attributes this risk to the Federal Reserve’s interest rate hikes, which, despite expectations, have not curbed the strength in jobs and wage growth. Recent data reveals a substantial increase in nonfarm payrolls and a monthly wage growth of 0.6%, double the consensus forecast. Unemployment remains at a historically low 3.7%.

Jobs and Wages Surge

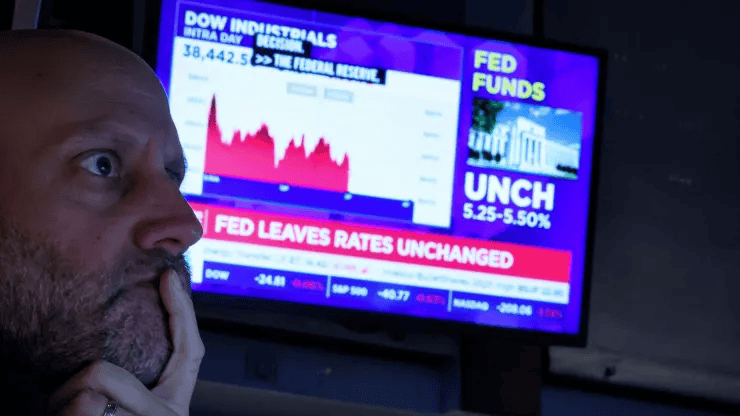

Fed Chair Jerome Powell’s announcement that rate cuts are unlikely in March contradicts market expectations. Smead, known for predicting the resilience of the U.S. consumer amid tighter monetary policy, suggests that the real risk lies in the robust economy despite the Fed’s 500 basis points interest rate hikes.

Wage growth continues to outpace inflation, challenging the effectiveness of the Fed’s policy tools. Smead attributes the decline in the Consumer Price Index (CPI) to external factors like falling energy prices rather than the Fed’s aggressive monetary tightening.

Federal Reserve’s Dilemma

In the wake of these robust economic indicators, Cole Smead questions the effectiveness of the Federal Reserve’s efforts to rein in the economy. Despite a series of interest rate hikes totaling 500 basis points, the job market and wage growth have not been curtailed as anticipated. Federal Reserve Chair Jerome Powell’s recent announcement that rate cuts in March are unlikely adds to the complexity of the situation.

If the strength in the job market and consumer sentiment persists, the Fed may need to maintain higher interest rates for an extended period. Smead draws parallels with a historical period (1964–1981) when a strong economy did not translate proportionately into stock market gains due to persistent inflationary pressures and tight monetary conditions, suggesting a potential similar scenario.

Despite Powell’s warning on rate cuts, the stock market has remained optimistic, with major Wall Street averages closing out a winning week. Smead questions the stock market’s valuation in light of the strong economy and the Fed’s commitment to high rates, cautioning that it poses a significant risk.

Wage Growth and Inflation

Smead emphasizes the resilience of wage growth, which continues to outpace inflation. While inflation has receded from its peak in June 2022, the U.S. Consumer Price Index increased by 0.3% month-on-month in December, exceeding consensus estimates and surpassing the Fed’s 2% target. Smead argues that the decline in the Consumer Price Index is more attributable to external factors like falling energy prices rather than the impact of the Fed’s monetary tightening.

Some strategists, however, argue that recent positive economic data indicates the Fed’s efforts to engineer a “soft landing,” reducing the likelihood of a recession. Richard Flynn of Charles Schwab U.K. notes that a strong jobs report, which would have triggered concerns previously, is not causing alarm now. Investors seem less inclined toward a rate cut, viewing the economy as coping well with the high-rate environment.

Daniel Casali, Chief Investment Strategist at Evelyn Partners, supports this perspective, emphasizing that investors are growing more comfortable with central banks balancing growth and inflation. Despite uncertainties, this benign macro backdrop is seen as relatively constructive for stocks.

Conclusion

As the stock market navigates the complexities of a strong economy, soaring jobs, and wages, investors are left to ponder the potential risks and rewards. The contrasting views from financial experts underscore the uncertainty surrounding the market’s trajectory. Whether the stock market is genuinely in a ‘very dangerous’ position or merely experiencing a period of adjustment remains a topic of intense debate among market participants. Investors must carefully monitor evolving economic indicators and policy decisions to make informed decisions in this dynamic financial landscape.