In the dynamic world of cryptocurrency, Bitcoin recently faced a 7% decline, bringing its value close to the $40,000 mark.

While market fluctuations are not uncommon in the crypto space, experts are expressing confidence that this pullback will be short-lived.

Bitcoin Experiences a 7% Decline, Approaching $40,000

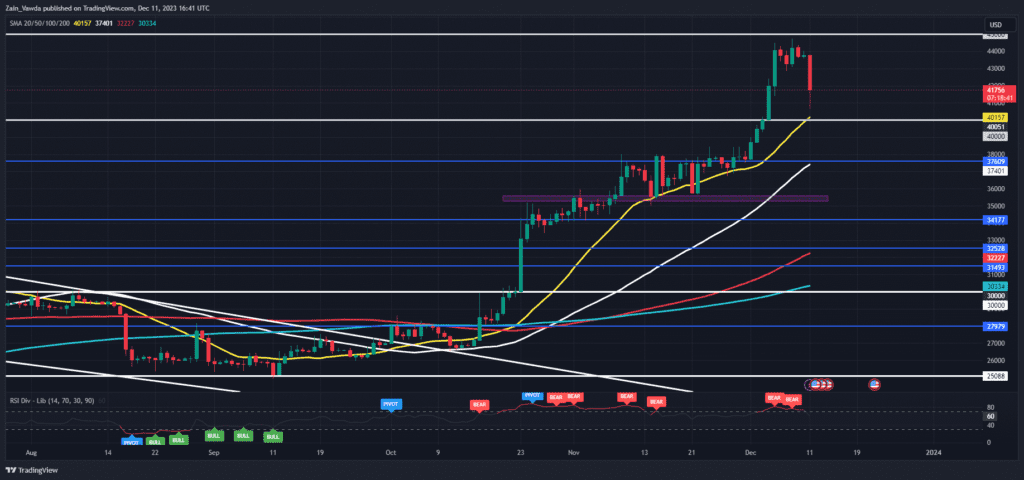

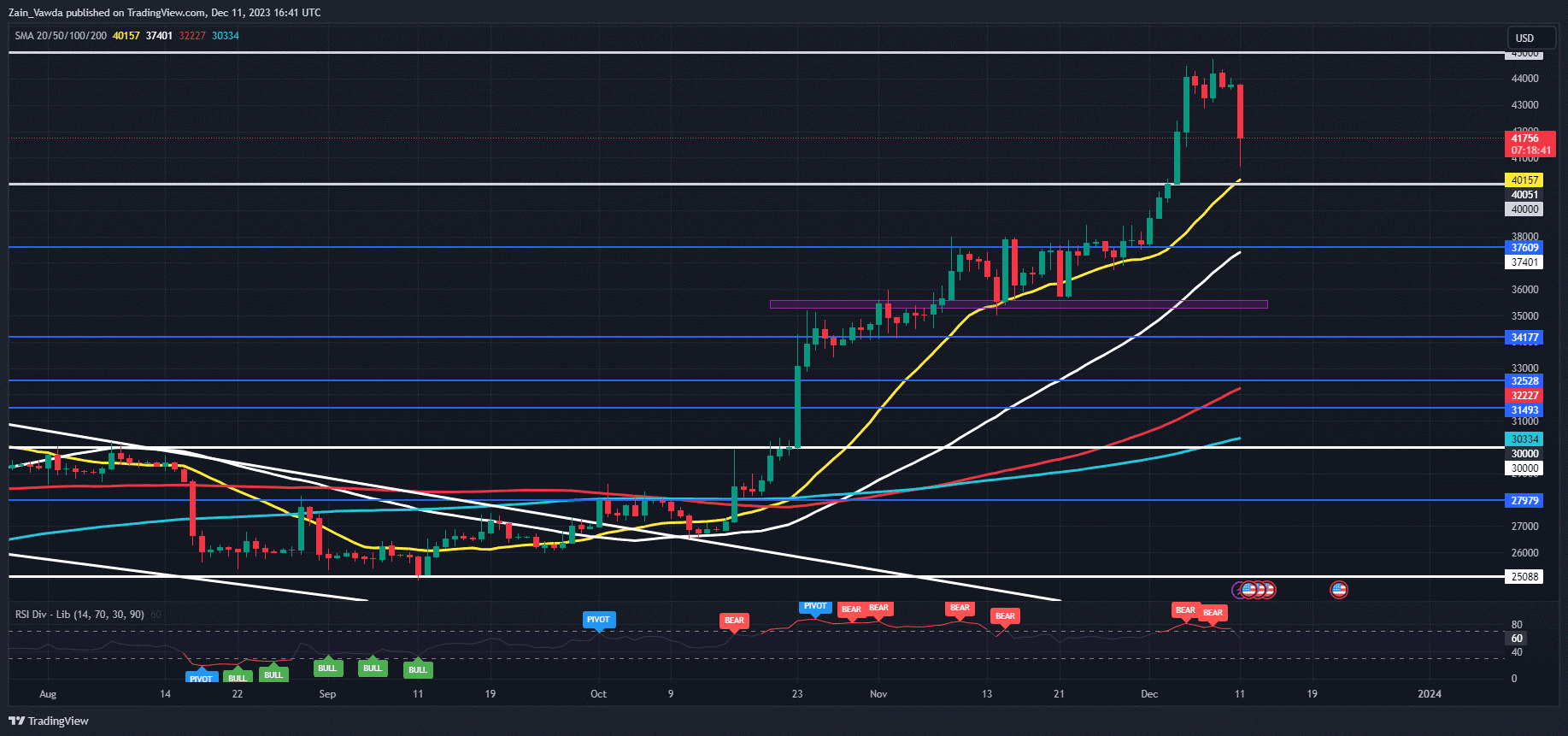

Bitcoin, the pioneering cryptocurrency, encountered a notable setback as its value dropped by 7%, hovering around the $40,000 threshold. This movement follows a period of relative stability and comes as a point of interest for both seasoned investors and those closely monitoring the crypto market.

Bitcoin (BTC/USD) Sank as much as 7.5% overnight to a low of around $40520, which is just a whisker away from the psychological $40000 level. There does not appear to be any singular driving force behind the move except perhaps the slightly stronger US Dollar. I however think that this is in part down to profit taking ahead of the Risk Events this week and the end of year holidays.

Expert Opinions

Despite the temporary decline, industry experts and analysts are optimistic about Bitcoin’s resilience. Many suggest that the pullback will be short-lived, citing various factors that could contribute to a swift recovery. Market volatility, inherent to the cryptocurrency landscape, is often met with rapid corrections.

Bitcoin’s recent dip is attributed to a combination of factors, including global economic uncertainties, regulatory developments, and profit-taking by investors who had benefited from the cryptocurrency’s earlier bullish run. Such market dynamics are typical in the crypto space and are often followed by periods of stabilization and renewed growth.

Technical analysts are closely examining charts and trends to gain insights into the potential trajectory of Bitcoin. While short-term fluctuations are part of the cryptocurrency market’s nature, many analysts believe that Bitcoin’s fundamentals remain robust, and any retracement is expected to be temporary.

Sharp drawdowns have been part of every previous bitcoin bull cycle but have been elusive in the past weeks as BTC rose nearly without pause from $27,000 to nearly $45,000 since Oct. 1.

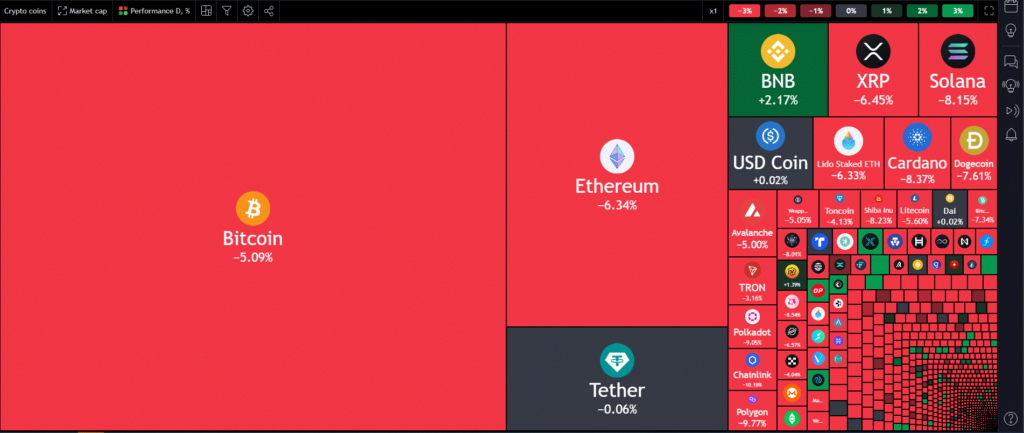

Ether (ETH), the second largest cryptocurrency, also tumbled over 7% in the same period to below $2,200.

Most of the rest of the cryptocurrencies also suffered large declines, with Ripple-linked (XRP), Dogecoin (DOGE), native tokens of Chainlink (LINK) and Cardano (ADA) nursing 8% to 12% losses during the day.

Some altcoins defied the trend, with tokens of Avalanche (AVAX), Injective (INJ) and Optimism (OP) being among the very few gainers.

Long-Term Outlook

Despite the recent dip, the long-term outlook for Bitcoin remains positive for many investors. The cryptocurrency has demonstrated resilience over the years, bouncing back from various market challenges. Additionally, growing institutional interest and adoption continue to contribute to Bitcoin’s credibility as a store of value.

A pullback should not be viewed in a negative light as the overall cloud which many though would hover over the Crypto sector cleared long ago. This is something I have previously discussed but has actually been pointed out in research of late as well. According to research released recently by Coinwire.com, 83% of Crypto mentions in op publications have been positive in 2023. This would explain the resilience of the industry in a time when it has faced a number of challenges.

In response to the dip, some investors may view this as an opportunity to accumulate Bitcoin at a lower price. Market sentiment often influences investment decisions, and experienced traders may see short-term retractions as part of the broader market cycle.

Bitcoin’s recent 7% dip to near $40,000 has captured the attention of the cryptocurrency community and financial analysts alike. While short-term fluctuations are inherent to the crypto market, experts are optimistic about the digital currency’s ability to weather the storm. As Bitcoin enthusiasts closely monitor its movements, the consensus remains that this pullback will likely be short-lived, with the cryptocurrency poised for potential recovery in the near future.

1 thought on “Bitcoin Experiences a 7% Decline, Approaching $40,000; Analysts Predict Brief Retraction”