Market News Oil futures initiated the new year with an increase on Tuesday as an Iranian warship made its entry into the Red Sea.

As the world ushered in the new year, global oil futures experienced a notable surge on Tuesday, triggered by geopolitical developments following the entry of an Iranian warship into the Red Sea. The impact of such events on oil prices remains a focal point for investors and analysts, adding an intriguing dimension to the dynamics of the energy market.

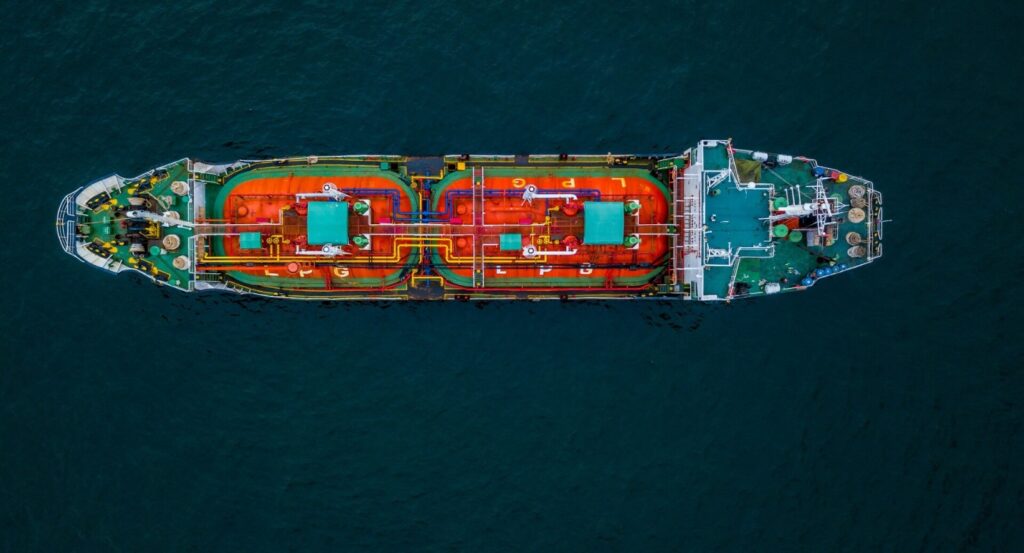

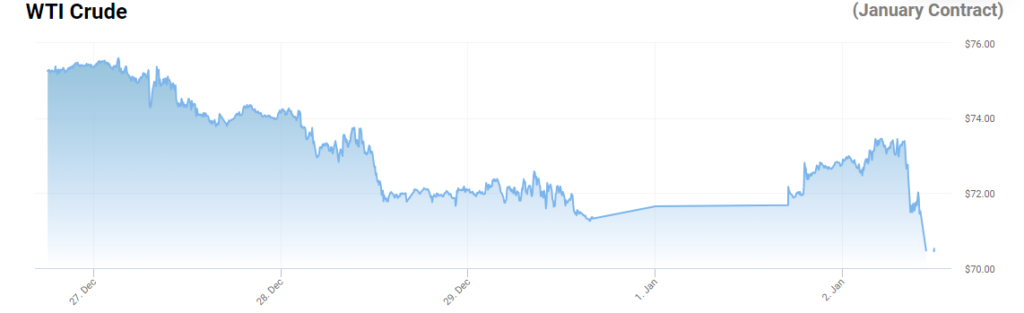

Oil futures saw an increase on Tuesday as an Iranian warship entered the Red Sea, raising concerns about potential disruptions in crude supply due to previous attacks by Iran-backed Houthi rebels in Yemen. West Texas Intermediate crude for February delivery rose 2.4% to $73.36 a barrel, while March Brent crude, the global benchmark, increased 2.4% to $78.90 a barrel. The rise in oil prices was triggered by heightened tensions in the region, with the U.S. military responding to Houthi rebel attacks on a cargo ship in the Red Sea, leading to an escalation of the maritime conflict linked to the war in Gaza.

- Oil prices experienced volatility on Tuesday following Iran’s deployment of a warship to the Red Sea, heightening tensions in a crucial waterway for global shipments, where vessels have previously been targeted by Yemen’s Houthi rebels.

- The West Texas Intermediate (WTI) contract for February showed a marginal gain of 1 cent, or 0.01%, reaching $71.66 a barrel on Tuesday. Meanwhile, the Brent contract for March recorded a modest increase of 14 cents, or 0.18%, trading at $77.18.

- Earlier in the trading session, crude prices had surged more than 2%.

- Iran’s announcement on Monday about sending the Alborz destroyer through the strategic Bab al-Mandeb Strait raised concerns, although the country’s state media provided no details about the warship’s specific mission. Iran stated that such operations are conducted periodically in the Red Sea to secure shipping routes.

Oil Futures on the Rise

Tuesday witnessed a robust uptick in oil futures, marking the beginning of the new year with heightened market activity. The surge in oil prices came in response to unfolding geopolitical tensions related to the movement of an Iranian warship into the strategically significant Red Sea region.

The entry of the Iranian warship into the Red Sea has raised eyebrows and fueled discussions on the geopolitical stage. The Red Sea is a vital maritime route, and any military movement in this region tends to reverberate across global energy markets. Investors are closely monitoring the situation, gauging potential impacts on oil supply routes and geopolitical stability.

Iran’s Strategic Move

The deployment of an Iranian warship to the Red Sea underscores the geopolitical maneuvering in the region. Such strategic movements often carry implications for oil-producing nations and contribute to fluctuations in oil prices. The entrance of the warship adds a layer of complexity to an already intricate geopolitical landscape, with potential consequences for the energy market.

The deployment of an Iranian warship to the Red Sea underscores the geopolitical maneuvering in the region. Such strategic movements often carry implications for oil-producing nations and contribute to fluctuations in oil prices. The entrance of the warship adds a layer of complexity to an already intricate geopolitical landscape, with potential consequences for the energy market.

The geopolitical developments in the Red Sea region add uncertainty to the global economic landscape, influencing the outlook for oil markets in the coming months. Analysts are closely monitoring the situation for any potential escalation that could impact oil supply chains, production, and prices.

As oil futures experienced a notable rise on the first trading day of the new year, driven by the entry of an Iranian warship into the Red Sea, the global energy landscape faces increased volatility. Geopolitical tensions continue to be a key determinant of oil prices, and market participants will remain vigilant, assessing the evolving situation and its potential ramifications throughout the year.