The upcoming week is set to deliver a flurry of economic data, with notable highlights including inflation updates from both the United States and mainland China, the UK’s November GDP figures, and the convening of the Bank of Korea, marking the first APAC central bank meeting in 2024. Additionally, industrial production figures from various economies, trade data from Germany and China, and the S&P Global Investment Manager Index will capture investor attention.

As 2024 begins, investors have adopted a cautious stance, driven by uncertainties regarding potential policy shifts and their timing. The S&P Global Investment Manager Index for the week will be closely observed to gauge any shifts in investor sentiment during the New Year. This follows a surge in US equity investors’ risk appetite to a two-year high in December, as per the IMI survey, with optimism about gains for the S&P 500 index by the end of 2024.

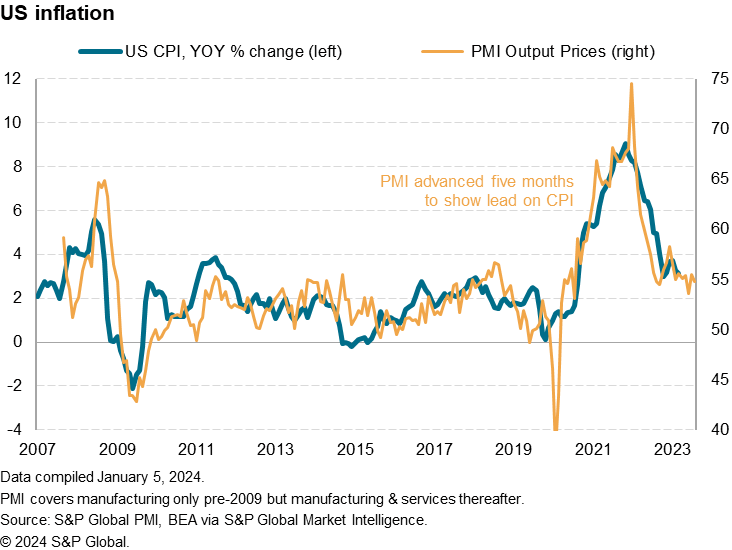

A key data point on the agenda is the US Consumer Price Index (CPI) for December, scheduled for release on Thursday. Leading indicator properties from PMI prices data hint at a certain resilience in US inflation around current levels. Given expectations for the Federal Reserve to adjust rates based on progress against inflation, the upcoming CPI reading becomes crucial for shaping expectations. Additionally, US trade and producer price data will be closely monitored.

In the UK, the release of November GDP data on Friday will provide insights into economic performance. Early indications from the UK PMI suggest a rise in output in the final months of the year, alleviating concerns after a 0.3% GDP contraction in October. Monday will see the release of UK recruitment survey data, shedding light on labor market and wage conditions, particularly amid mounting pressure on the Bank of England to consider rate adjustments.

Eurozone concerns regarding a potential recession put the spotlight on industrial production updates from Germany, France, and Italy, along with unemployment figures for the entire currency area.

Closing the week, the Bank of Korea will convene on Thursday, January 11. While no shifts in monetary policy are anticipated, market participants will keenly observe for any indications of a potential pivot toward a rate cut.

Late last year, US inflation exhibited a faster-than-expected cooling trend. The core measure of Personal Consumption Expenditures (PCE) price inflation showed a 0.1% decline in November, bringing the annual rate below 3%. The core rate, targeted at 2% by the Federal Open Market Committee (FOMC), dropped to 3.2%, the lowest since March 2021.

Market watchers await further inflation insights from the Consumer Price Index (CPI) in the coming week. November’s annual CPI inflation eased to 3.1%, with a core rate holding steady at 4%. The possibility of further downward progress is uncertain, especially as forward-looking survey data suggests some persistence above the 2% level in the coming months.

The upcoming months will be pivotal in evaluating these dynamics and assessing the impact of geopolitical issues on supply chains. The Federal Reserve has signaled a shift, acknowledging that with core PCE lower than anticipated, its policy stance may be overly restrictive. Consequently, early 2024 rate cuts are gaining likelihood, with markets pricing in a 98% chance of the first cut occurring by May 2024.

Here’s an some extra preview of what to watch for in the economic sphere during the week commencing January 8, 2024.

- Keep an eye on the latest unemployment figures, which provide a crucial insight into the labor market’s health.

- Inflation numbers are closely monitored for signs of rising prices, influencing central bank decisions. Top of Form

- Watch for any statements or decisions from the Federal Reserve, as they can have a significant impact on global markets.

- Several major companies are set to release their earnings reports. These reports can influence stock markets and reflect broader economic trends.

- Any updates on trade negotiations or agreements between major economies can impact global trade dynamics.

- Keep an eye on geopolitical developments that might have economic implications.

- Housing market indicators, such as home sales and building permits, can provide insights into the broader economic health.

- Monitor the cryptocurrency market for any significant price movements or regulatory developments.

- Assess global economic reports to gauge the overall sentiment and trends in the international economy.

- Keep an eye on economic developments in emerging markets, as they can impact global economic stability.

The economic outlook for the week starting January 2024, is marked by a confluence of key indicators and events that will likely influence financial markets and policy decisions. Investors and analysts are advised to stay informed and adapt their strategies accordingly as the week unfolds.