AI Investing in artificial intelligence (AI) continues to be an enduring trend, driven by the transformative impact of AI on efficiency across various sectors. As businesses strive for greater productivity and profitability, the integration of AI into their operations becomes a strategic imperative.

Despite the widespread adoption of AI, not all companies are equally positioned for investment success due to overly optimistic valuations. However, three companies present appealing opportunities at reasonable prices: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Taiwan Semiconductor (NYSE: TSM), and Airbnb (NASDAQ: ABNB).

Taiwan Semiconductor (NYSE: TSM): Powering the AI Revolution

- Core Business

Taiwan Semiconductor, a global semiconductor manufacturing giant, plays a pivotal role in the AI ecosystem by producing advanced microchips. Collaborating with industry leaders like Apple, Nvidia, and AMD, TSMC’s cutting-edge technology enables the development of powerful chips crucial for AI applications.

- Technological Edge

TSMC’s technological prowess is evident in its ability to manufacture chips with 3 nanometer (nm) conductor spacing, setting the industry standard. With plans for even smaller 2 nm chips set to launch in 2025, the company is poised to meet the escalating demand for high-performance AI hardware.

- Growth Potential

The compound annual growth rate of 50% projected for AI chip revenue by 2027 positions Taiwan Semiconductor as a key player in the AI landscape. Investors looking to ride the wave of AI-driven innovations should keep a close eye on TSMC in February.

Alphabet Inc. (NASDAQ: GOOG, GOOGL): AI Pioneer with Robust Fundamentals

- AI Development Hub

Alphabet Inc., the parent company of Google, has been a trailblazer in AI development. Its generative AI platform, Gemini, enhances search capabilities and tackles complex queries, while the Google Cloud division plays a crucial role in providing cloud services for AI applications.

- Market Impact

Google Cloud, utilized by 70% of generative AI unicorns, saw a remarkable 26% revenue growth in the fourth quarter. Alphabet’s dominance in AI technologies positions it as a key player, making it an attractive choice for investors seeking exposure to the AI market.

- Attractive Valuation

Despite its influential position, Alphabet trades at a valuation comparable to the S&P 500, making it appear undervalued. This presents investors with an opportunity to tap into Alphabet’s AI-driven potential at a reasonable price.

Airbnb (NASDAQ: ABNB): Beyond Travel - Leveraging AI for Success

- Diverse AI Applications

While primarily known as a travel platform, Airbnb has quietly integrated AI into its operations for strategic advantages. The company employs AI algorithms to assess and prevent potential disruptions, such as parties, by analyzing various factors before approving booking requests.

- Strategic Acquisition

Airbnb’s recent acquisition of GamePlanner.AI, founded by the minds behind Apple’s Siri and Samsung’s Bixby, underscores its commitment to enhancing AI capabilities. This move positions Airbnb not just as a travel industry player but as a tech-savvy company leveraging AI for sustained growth.

- Solid Valuation

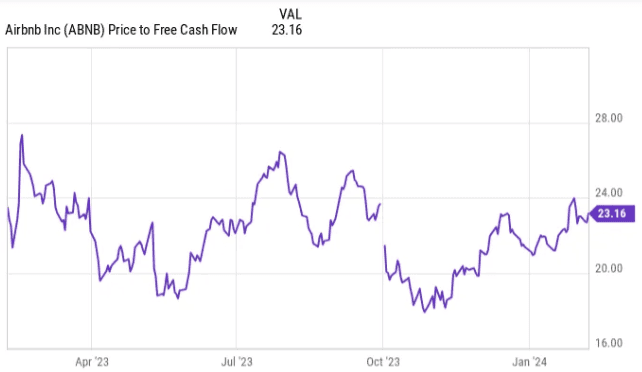

Despite its unconventional positioning in the AI sector, Airbnb’s reasonable valuation at 23 times free cash flow, coupled with its rapid growth, makes it an enticing investment option for February.

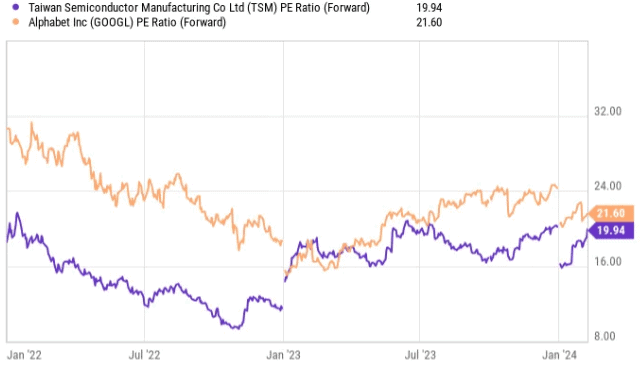

All three companies are attractively priced. Comparing their forward price-to-earnings (P/E) ratios with the S&P 500 baseline of 20, Alphabet and Taiwan Semiconductor trade within this range. Despite being considered average by market standards, their pivotal roles in AI make them appear undervalued.

Airbnb, though presenting a unique challenge in valuation due to a one-time tax benefit in Q3, is evaluated based on its free cash flow. Trading at 23 times free cash flow, a typical valuation over the past year, Airbnb emerges as an attractive investment, especially considering its robust growth trajectory. For context, Alphabet trades at 27 times free cash flow, reinforcing Airbnb’s appeal as a cost-effective option.

In summary, all three stocks—Alphabet, Taiwan Semiconductor, and Airbnb—offer compelling investment opportunities in February. With AI remaining a prominent theme for each, these companies are poised for sustained success in the evolving landscape of artificial intelligence.

Conclusion

As we navigate through February, the convergence of AI and investment opportunities is unmistakable. Taiwan Semiconductor, Airbnb, and Alphabet Inc. stand out as top AI stocks, each bringing unique strengths and growth prospects to the table. Whether you are a seasoned investor or someone exploring AI-related opportunities for the first time, these three stocks offer a compelling entry point into the evolving landscape of artificial intelligence.