Here are the Judge Orders Binance Founder cz Must Stay in US Until Sentencing Binance founder Changpeng “CZ” Zhao has been ordered to stay in the United States until his sentencing in February, with a federal judge determining there’s too much of a flight risk if the former crypto exchange CEO is allowed to return to the United Arab Emirates

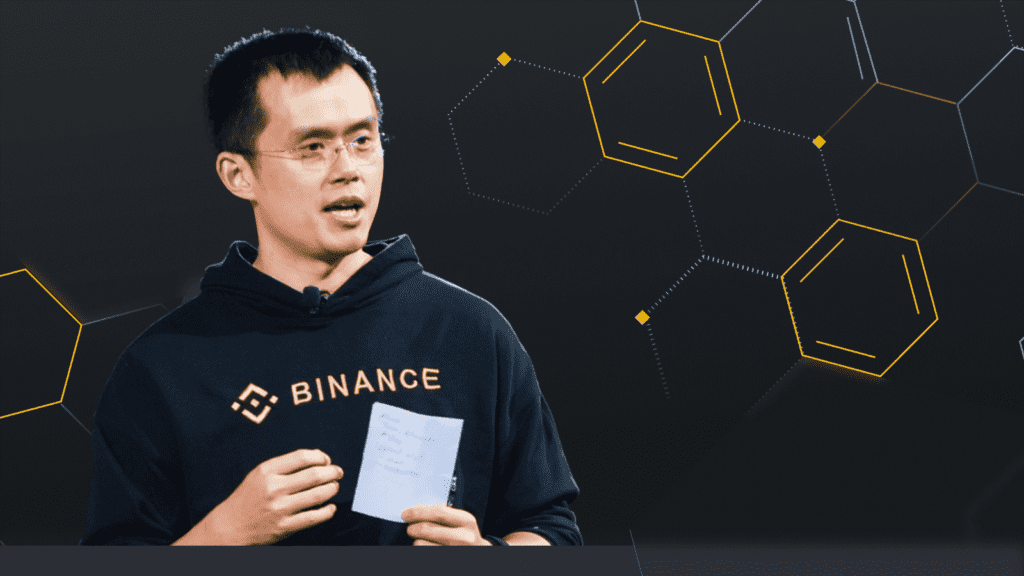

Binance CEO Changpeng Zhao

In a surprising turn of events for the cryptocurrency community, Binance founder and CEO Changpeng Zhao, commonly known as CZ. On Dec. 7, Seattle District Court Judge Richard Jones ordered Zhao to remain in the United States until his sentencing. The legal development adds a layer of complexity to the regulatory challenges that major cryptocurrency exchanges, including Binance, have been facing globally.

The decision compelling CZ to stay in the U.S. comes amid regulatory scrutiny and legal challenges against Binance, one of the world’s largest cryptocurrency exchanges. Authorities in various jurisdictions have been taking a closer look at Binance’s operations, expressing concerns related to compliance with local regulations and potential involvement in illicit activities.

The Specifics of the Order

The details surrounding the order for CZ to stay in the U.S. until his sentencing are not yet fully disclosed. However, such orders typically stem from legal proceedings, investigations, or charges that require the individual’s presence in a specific jurisdiction. In this case, CZ’s mandated stay in the U.S. suggests that he is facing legal matters that demand his direct involvement in the country’s legal processes.

Moreover, it marks the second time in less than a year that the crypto universe, still reeling from a crash that shaved some $2 trillion off the value of the market, loses one of its biggest stars. Bankman-Fried may have been the best known name in crypto but Zhao, worth almost $100 billion at his zenith in early 2022, was the wealthiest and most powerful.

“This is a big deal,” said Michael Rosen, chief investment officer at Angeles Investments. Zhao’s “prominence helped him until it hurt him,” converting him eventually into a big target for authorities.

Richard Teng, a civil servant-turned-crypto executive, succeeded Zhao.

Binance Coin, a cryptocurrency also known as BNB that is the main transactional token on the exchange, dropped more than 8% on Tuesday.

Implications for Binance and the Crypto Industry

CZ’s legal challenges and the subsequent order to remain in the U.S. have notable implications for Binance and the broader cryptocurrency industry.

Impact on Binance Operations: The founder and CEO of a major cryptocurrency exchange being tethered to a specific jurisdiction due to legal matters could impact the day-to-day operations and decision-making processes at Binance. It may prompt the exchange to reassess its global strategy and compliance measures.

Regulatory Scrutiny: The order for CZ to stay in the U.S. is indicative of the increasing regulatory scrutiny faced by major cryptocurrency platforms. As governments worldwide tighten their grip on the industry, exchanges are compelled to enhance compliance measures to navigate a complex and evolving regulatory landscape.

Market Sentiment: News of legal challenges involving a prominent figure like CZ can influence market sentiment. Traders and investors may react to such developments, leading to potential fluctuations in the valuation of cryptocurrencies, especially those traded on Binance.

Industry-Wide Reflection: CZ’s legal situation may trigger a broader reflection within the cryptocurrency industry about the need for enhanced regulatory compliance, transparency, and proactive engagement with regulators. It could serve as a catalyst for industry participants to address regulatory concerns collaboratively.

The order for Binance founder CZ to stay in the U.S. until sentencing underscores the intensifying regulatory environment surrounding cryptocurrency exchanges. As the industry grapples with increased scrutiny, legal challenges, and the need for heightened compliance, major players like Binance face the imperative to adapt to evolving regulatory landscapes globally. The outcome of CZ’s legal proceedings will be closely watched, as it could potentially set precedents and influence the future trajectory of cryptocurrency exchanges and their leaders