The stock experienced a favorable market response on Friday, soaring by 20%; however, the anticipated yield is expected to be relatively modest.

Meta Platforms, known as META, has been actively returning cash to its shareholders through share repurchases. In a surprising move alongside its fourth-quarter earnings release, the company announced the initiation of a quarterly dividend payment. Shareholders registered by February 22 will receive a dividend of $0.50 per share on March 26.

Unexpected Pivot

Meta Platforms has been traditionally known for returning value to its shareholders through share repurchases. However, the unexpected introduction of a quarterly dividend adds a new dimension to the company’s approach to capital allocation. This pivot has sparked curiosity and interest among stock investors, prompting a closer examination of Meta’s rationale and the potential impact on shareholder value.

Analysts reacted positively to this development, with senior equity analyst expressing appreciation, stating, “We also commend Meta for instituting a dividend alongside share buybacks.”

Dividend Details

The company plans to pay a dividend of $0.50 per share to shareholders of record as of February 22, with the payment scheduled for March 26. While this represents a relatively modest initial dividend, it introduces a regular payout schedule, providing investors with a predictable income stream alongside the potential for capital appreciation.

The unveiling of the dividend news, combined with the overall tone of the earnings report, led to a significant surge in Meta’s stock on Friday, witnessing a rise, reaching a new record high of $474.87.

Despite this dividend announcement, share buybacks will continue to be the primary method for Meta to return cash to its shareholders. From 2021 to 2023, the company executed repurchases totaling $92.3 billion, and as of the end of 2023, it had $81 billion authorized for additional buybacks. The newly introduced dividend is expected to result in a payout of approximately $5.3 billion for 2024.

During the earnings call, when questioned about the rationale behind initiating a dividend, CFO Susan Li emphasized the company’s commitment to returning capital to shareholders. She clarified that the dividend serves as a complement to the existing share repurchase program, with share repurchases remaining the primary mode of returning capital. The introduction of a dividend aims to provide a more balanced capital return program and added flexibility for future capital return strategies.

As for the size of Meta’s dividend, the initial annual rate of $2 per share corresponds to an 11.1% payout ratio, resulting in a forward yield of less than 0.5% based on the current closing price. In comparison to its mega-cap growth peers like Apple and Microsoft, whose yields are 0.5% and 0.7%, respectively, Meta’s dividend yield is relatively lower. The Morningstar Dividend Composite Index, for context, boasts a yield of 3.17%.

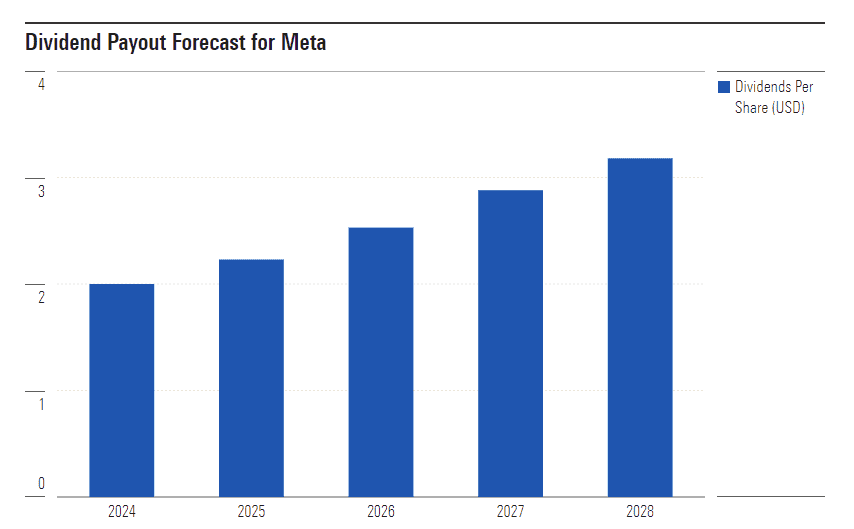

According to forecasts by Morningstar equity analysts, the annual rate could increase to $3.18 per share by 2028. However, even if Meta’s stock price remains constant over the next four years, the dividend yield would still be less than 1%, falling below the expectations of most income-focused investors.

Yield and Growth Outlook

The initial annual dividend rate of $2 per share equates to an 11.1% payout ratio, resulting in a forward yield of less than 0.5% based on the current closing price. Analysts project an increase in the annual rate to $3.18 per share by 2028, potentially offering a more attractive yield in the future. However, even with this growth outlook, Meta’s dividend yield currently falls below the levels seen in some of its mega-cap growth peers.

Conclusion

As Meta Platforms ventures into the realm of quarterly dividends, stock investors find themselves at the crossroads of tradition and innovation in capital allocation. The company’s strategic move to introduce dividends while maintaining a focus on share buybacks reflects a nuanced approach to shareholder value. Investors will closely monitor how Meta’s dividend story unfolds, assessing its impact on the overall investment thesis and its alignment with the company’s future growth trajectory.