Elon Musk’s recent warning about advancing AI and robotics outside of Tesla unless he gains more voting control is prompting concerns among governance experts and analysts. This move could potentially encroach on his responsibilities as CEO and lead to uncertainties about the valuation of the automaker, according to industry observers.

Musk’s Stipulation for Increased Voting Control

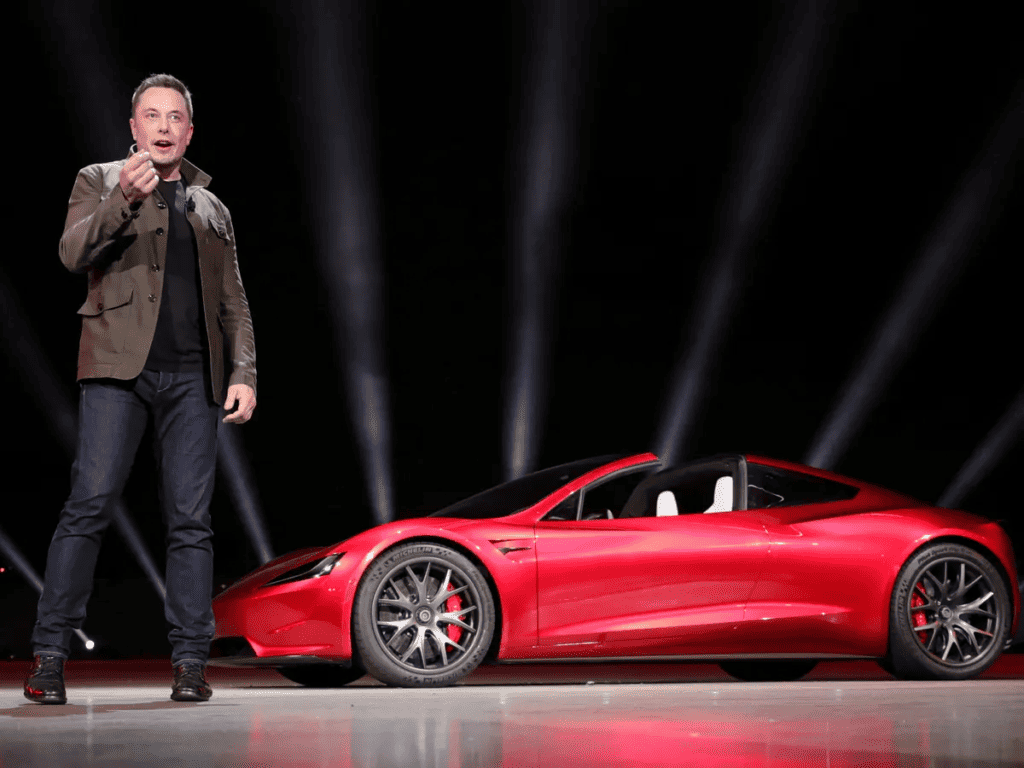

Elon Musk made headlines when he declared on Monday that he would be “uncomfortable” steering Tesla’s endeavors in AI and robotics unless he secures approximately 25% voting control within the company. This stipulation, communicated through Musk’s social media platform, X, has fueled discussions about the potential impact on Tesla’s corporate governance and decision-making processes.

In a surprising shift, Musk stated on Monday that he would feel “uncomfortable” leading Tesla’s charge in AI and robotics unless he attains approximately 25% voting control within the company. He expressed the desire to have enough influence while still allowing for the possibility of being overruled. This announcement was made through his X social media platform.

Shares Respond to Musk’s Statement

Following Musk’s announcement, Tesla’s shares experienced a modest uptick of around 0.5%, reaching $219.91. This move marks a significant departure for Musk, who has consistently positioned Tesla as an “AI/robotics company” due to its advancements in automated driving technology and the unveiling of prototype humanoid robots.

Following Musk’s statement, Tesla’s shares (TSLA.O) experienced a marginal increase of around 0.5%, reaching $219.91. Musk, known for positioning Tesla as an “AI/robotics company,” raised eyebrows as some experts highlighted potential conflicts of interest arising from his tweets.

Ann Lipton, a professor at Tulane Law School, expressed concern, stating, “The problem is his tweets suggest that in his capacity now as CEO and director, he is not only turning down profitable Tesla opportunities based on his personal preferences but also redirecting them to his private companies.”

Analysts warned that any shift in technology development away from Tesla could harm the company’s share value by eliminating potential avenues for growth. Musk and Tesla were not available for comment at the time of reporting.

Governance and Conflict of Interest Concerns

Governance experts and legal analysts have been quick to scrutinize Musk’s conditions, expressing concerns about potential conflicts of interest and governance issues. Ann Lipton, a professor at Tulane Law School, pointed out that Musk’s statements suggest a conflict of interest, implying a deviation from profitable opportunities for Tesla based on personal preferences, potentially redirecting them to Musk’s private enterprises.

Legal principles, including the corporate opportunity doctrine, prohibit CEOs and directors from pursuing business opportunities for personal gain that rightfully belong to the company. Charles Elson, the founding director of the Weinberg Center for Corporate Governance at the University of Delaware, emphasized that it would be illegal for Musk to proceed with developing technologies Tesla has promoted without the company’s consent.

Despite being Tesla’s largest investor with a 13% stake, Musk’s voting control has diminished in the past two years due to stock sales. Musk’s stake could potentially rise to nearly 23% if he exercises all his stock options, but he may need to sell a portion to cover taxes related to the exercise.

Analysts view Musk’s recent demands as strategic posturing, possibly connected to an upcoming Delaware court ruling on his previous compensation package. Musk is awaiting a verdict in a shareholder lawsuit alleging that he wielded undue influence to secure an outsized compensation package not contingent on full-time work at Tesla.

J.P. Morgan analyst Ryan Brinkman suggested that Musk’s public airing of views could be an attempt to pressure the board and potentially raise the likelihood of his departure as CEO or a dilution of investors’ holdings through an award of shares to him. Overall, experts believe that while Musk may encounter opposition from major shareholders like Vanguard and BlackRock, Tesla’s board may be more tolerant of his demands given his crucial role in the company.

Conclusion:–

Elon Musk’s warning about Tesla’s stake and the conditions attached to it have stirred a complex web of governance questions within the electric vehicle giant. As the industry awaits further developments, the outcome of Musk’s demands and their potential impact on Tesla’s corporate governance and valuation will be closely watched by investors, analysts, and industry observers alike.