Nvidia's Strategic Investments Propel Surge in Small AI Firms’ Stock Values

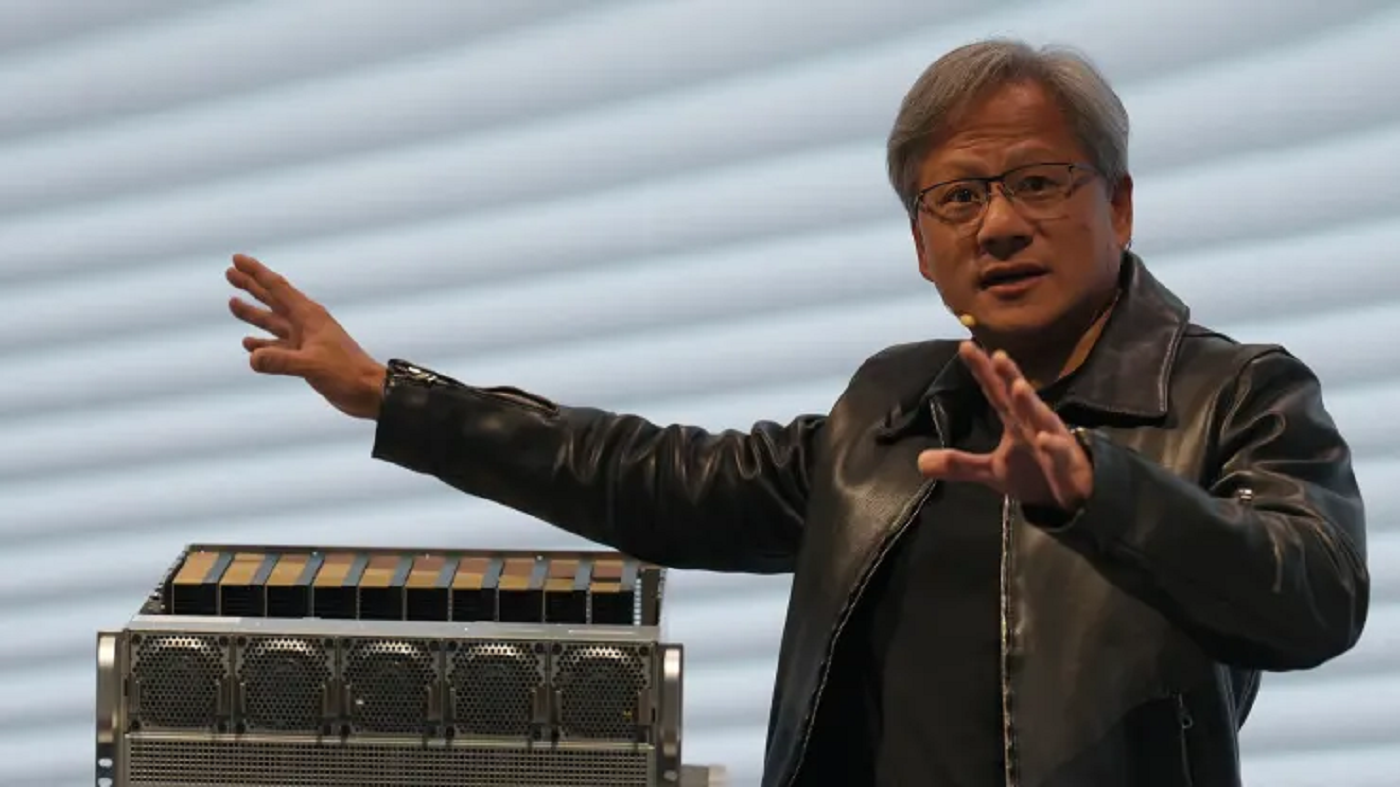

In a surge of enthusiasm for Nvidia’s AI narrative, investors eagerly pursue shares in companies the chipmaker is associated with. Nvidia recently revealed its stakes in various public firms, including Arm, SoundHound AI, Recursion Pharmaceuticals, Nano-X Imaging, and TuSimple, leading to a substantial uptick in their stock values. This revelation, made through a regulatory filing, spurred the irrational exuberance surrounding AI investments. Nvidia, currently the third most valuable U.S. company, has seen its shares rise over 200% in the past year due to heightened demand for its AI chips. Notably, SoundHound, Nano-X, and TuSimple experienced significant boosts in their stock prices following Nvidia’s disclosed investments. While SoundHound utilizes AI for speech and voice recognition, Nano-X focuses on AI in medical imaging, and TuSimple is an autonomous trucking company. Recursion Pharmaceuticals, another beneficiary of Nvidia’s investments, witnessed a 15% spike in its shares. As Nvidia prepares to unveil its quarterly earnings, analysts anticipate substantial year-over-year revenue growth, exceeding $20 billion. The chipmaker’s recent investments, particularly in the heart of the AI boom, highlight its strategic focus on transformative technologies. Nvidia’s involvement in the AI sector extends to startups like Cohere, Hugging Face, CoreWeave, and Perplexity, underlining its commitment to driving the evolution of AI-powered platforms.

Nvidia’s disclosure, made through a regulatory filing, brought to light its stakes in a handful of public companies, namely Arm, SoundHound AI, Recursion Pharmaceuticals, Nano-X Imaging, and TuSimple. The ensuing market response was nothing short of remarkable, as the shares of these Nvidia-backed companies experienced a notable upswing in value.

Nvidia’s own market standing has been nothing short of extraordinary, having recently overtaken tech giants like Amazon and Alphabet to become the third most valuable company in the United States, trailing only behind Apple and Microsoft. The company’s remarkable success over the past 12 months, with its shares surging over 200%, reflects the insatiable demand for its AI chips, integral to the operations of major players like Google, Amazon, and OpenAI.

The AI community witnessed a particularly strong reaction, with investors displaying heightened enthusiasm for companies associated with Nvidia. The disclosure served as a catalyst for a surge in the stock prices of the mentioned firms, signaling a trend of investors eager to align themselves with Nvidia’s influential position in the AI landscape.

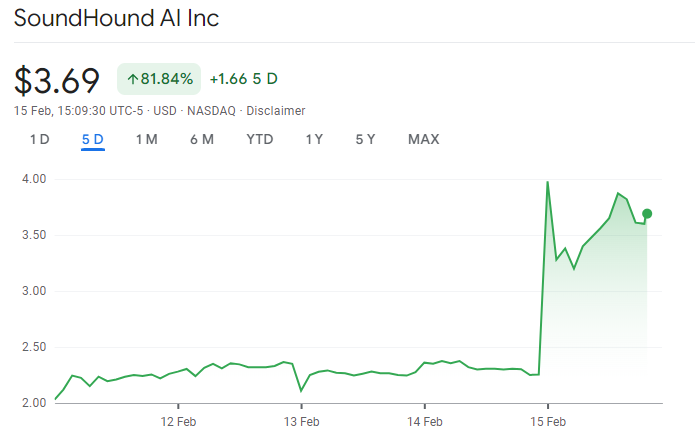

Among the companies benefiting from Nvidia’s disclosed investments, SoundHound AI witnessed a notable 68% jump in its stock value on the heels of the regulatory filing. Nvidia’s $3.7 million stake in SoundHound, dating back to a 2017 venture round, underscored the enduring impact of long-term strategic investments.

Similarly, Nano-X Imaging, specializing in AI-driven medical imaging, experienced a 59% surge in its stock value after Nvidia’s disclosure of a $380,000 investment. TuSimple, an autonomous trucking company, saw a remarkable 40% increase following the revelation of Nvidia’s $3 million stake.

As the industry digests these developments, the focus is now on Nvidia’s upcoming quarterly earnings report, where analysts anticipate year-over-year revenue growth exceeding 200%, surpassing $20 billion. Nvidia’s recent investments, particularly those at the forefront of the AI boom, underscore its pivotal role in shaping the future of artificial intelligence.

In conclusion, Nvidia’s strategic holdings disclosure has not only elevated its own standing but has also had a transformative effect on the fortunes of smaller AI companies. The market’s response reflects a growing recognition of the profound impact Nvidia continues to have in steering the trajectory of the AI landscape.