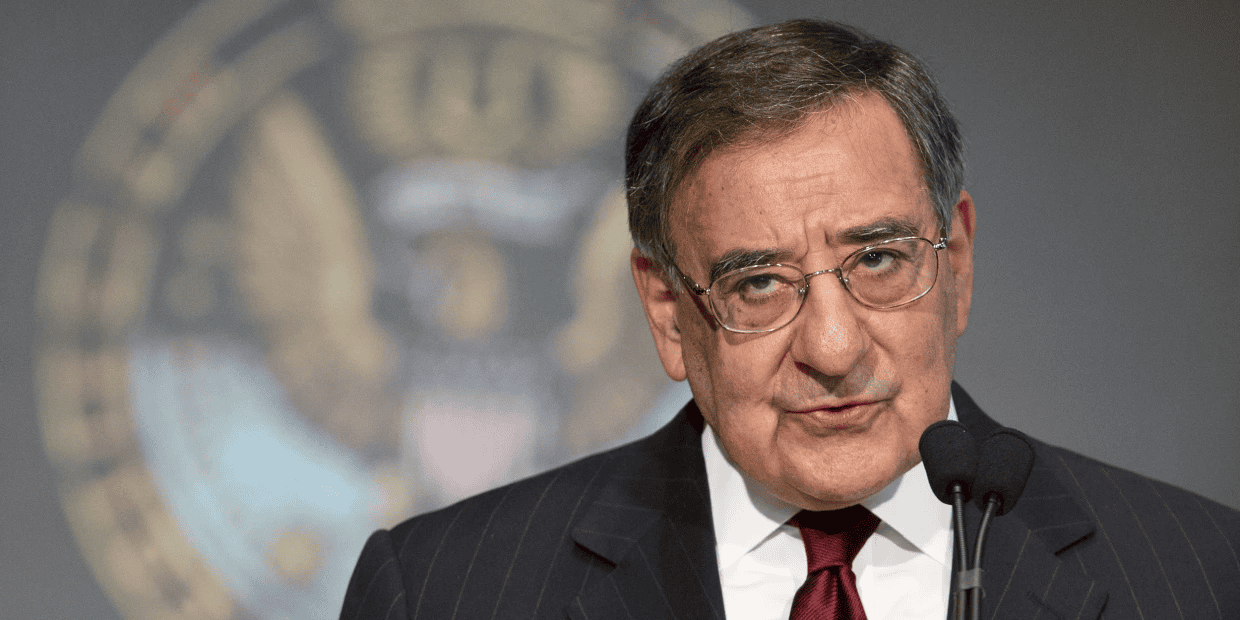

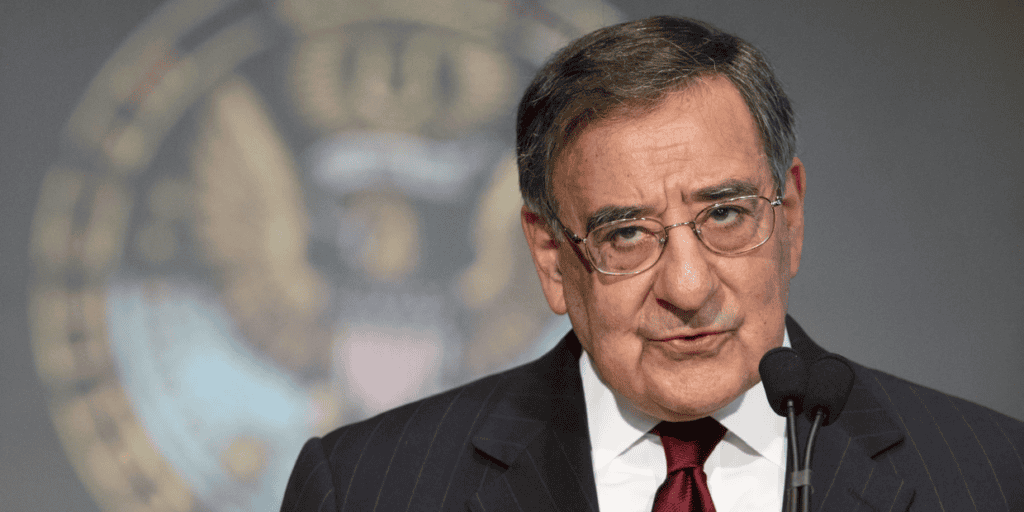

At the annual Assiom Forex event in Genoa, Panetta signaled imminent monetary policy changes. ECB officials plan to ease from April or June, contingent on inflation meeting the 2% target next year. Speaking at the annual Assiom Forex event in Genoa, Panetta underscored the urgency of initiating interest rate cuts in response to prevailing macroeconomic conditions. Panetta dismissed concerns about wage-driven inflation and urged against delayed action to prevent conflicting with the ECB’s objective. As discussions on easing pace emerge, he advocates a cautious, step-by-step approach. Addressing Italy’s economic outlook, Panetta anticipates a declining deficit but stable debt. While Italian banks currently show positive indicators, he advises vigilance for potential future challenges, emphasizing balanced asset-liability structures and prudent capital management.

“Macroeconomic conditions suggest that disinflation is at an advanced stage, and progress toward the 2% target continues to be rapid,” emphasized Panetta. His remarks reflect a sense of urgency, signaling that the time for a reversal in the monetary policy stance is swiftly approaching. The ECB, tasked with maintaining price stability, now grapples with the intricate challenge of balancing inflation targets amid a rapidly evolving economic landscape.

Loosening the Monetary Policy

The prospect of a policy shift by the ECB looms on the horizon, with indications pointing toward a potential move in April or June. Investors are closely monitoring developments, with many leaning toward an earlier adjustment. However, the decision rests heavily on the trajectory of inflation, which, despite recent declines, is not anticipated to reach the 2% target until the coming year.

Panetta addressed concerns about inflation expectations, stating, “There has been no upward de-anchoring of inflation expectations — if anything downside risks are emerging.” The specter of persistently high core inflation, he asserted, has proven to be groundless, alleviating some apprehensions within the economic sphere.

Wage Increases and Inflation

One prevailing narrative within the ECB has been the potential impact of wage increases on consumer price growth. Some policymakers argue that the ECB should wait for comprehensive data on these wage increases before making any policy adjustments. Panetta, known for his dovish stance, countered this perspective, stating, “The risk remains that still strong nominal wage growth could reignite inflation. This possibility should not be underestimated, but a closer look at the data allays these concerns.”

The Timing Conundrum

Panetta emphasized the importance of timing in the context of monetary policy adjustments. Delaying action too much could pose risks to the symmetrical nature of the ECB’s objectives. “If monetary policy were to take too long to accompany the ongoing disinflation, downside risks to inflation could emerge,” warned Panetta, underscoring the need for timely and strategic decision-making.

Pacing Easing Measures

As the ECB contemplates easing measures, discussions among officials have shifted to the pace at which these adjustments should occur. Panetta joined his colleagues in advocating for a prudent, step-by-step approach. “We need to consider the pros and cons of cutting interest rates quickly and gradually, as opposed to later and more aggressively, which could increase volatility in financial markets and economic activity,” he explained

Italy's Economic Outlook

Shifting focus to Italy’s economic landscape, Panetta provided insights into the fiscal landscape. While he acknowledged a predicted decrease in the fiscal deficit, he cautioned that the national debt is unlikely to see a significant reduction. “Over the next few years, despite the expected decline in the deficit, debt should remain broadly stable,” noted Panetta.

Despite the cautious economic outlook, Panetta painted a comparatively optimistic picture of Italian banks. Balance sheet indicators currently display positivity, with liquidity ratios exceeding regulatory requirements and improved profitability. However, he sounded a note of caution, stating that these favorable conditions might not last indefinitely.

Future Challenges for Banks

Panetta advised Italian banks to remain vigilant and prepare for potential challenges on the horizon. He emphasized the importance of maintaining a balanced maturity structure of assets and liabilities, effective management of non-performing loans, and safeguarding the overall soundness of their capital base.

In conclusion, Fabio Panetta’s recent statements underscore the intricate web of considerations that central banks must navigate in today’s economic climate. As the ECB prepares to potentially cut interest rates, the delicate balance between stimulating economic growth, managing inflation, and safeguarding financial stability remains at the forefront of policymakers’ minds. The coming months will undoubtedly reveal the nuanced path the ECB chooses to traverse in response to these complex economic challenges.