S&P 500: S&P 500 concludes Friday on a positive note, marking its lengthiest weekly winning streak since 2017: Live updates. In a significant turn of events, the S&P 500 closed higher on Friday, securing its longest weekly winning streak since 2017.

This achievement was marked by a positive conclusion to the trading week, reflecting the index’s resilience and investor confidence.

The S&P 500’s upward trajectory on Friday contributed to a notable milestone as it notched its lengthiest winning streak on a weekly basis since the year 2017. This consistent pattern of gains reflects the market’s ability to navigate various economic factors and uncertainties.

Despite ongoing market fluctuations and external challenges, the S&P 500’s positive closure signals a level of resilience within the broader market. Investors have continued to exhibit confidence, contributing to the sustained upward trend.

Throughout the trading day, live updates provided real-time insights into the market’s movements, capturing the dynamics that influenced the S&P 500’s performance. These updates offer a snapshot of the factors contributing to the index’s success and market sentiment.

The extended winning streak prompts a closer look at investor sentiment and the factors driving their decisions. The sustained positive performance suggests a certain degree of optimism and strategic positioning among market participants.

he reference to the longest weekly win streak since 2017 invites comparisons to that period, examining similarities and differences in market conditions, economic indicators, and global events that may be influencing the current trend.

The S&P 500’s success is not only a reflection of individual stock performances but also an indicator of broader market health. As a key benchmark index, its movements often influence market trends and investor behavior.

On Friday, the S&P 500 experienced a positive surge following more tempered inflation data, extending its winning streak for an eighth straight week. Wall Street seemed poised to prolong its year-end rally, with major averages reflecting the upbeat sentiment.

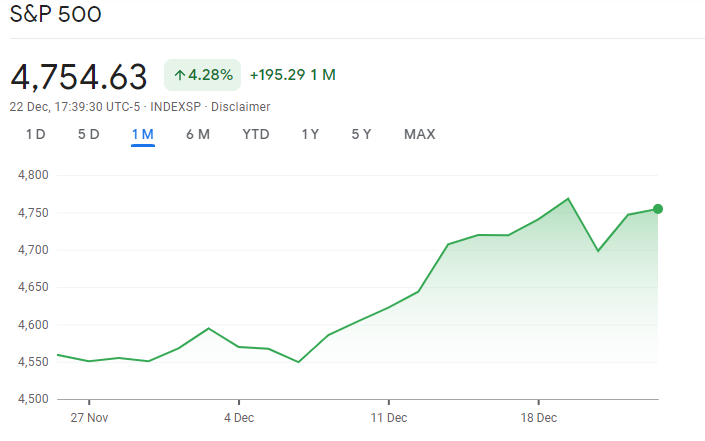

- The broad market index saw a modest gain of 0.17%, reaching 4,754.63. Currently, the S&P 500 stands just 0.9% away from its record close and 1.3% from its intraday record. Simultaneously, the Nasdaq Composite rose by 0.19% to 14,992.97, while the Dow Jones Industrial Average dipped slightly by 0.05% to 37,385.97.

- This impressive run marked the eighth consecutive positive week for all three major averages. For the S&P 500, this achievement hasn’t been seen since 2017, and for the Dow, it harks back to 2019. During the week, the S&P 500 advanced by 0.8%, the Dow added 0.2%, and the Nasdaq posted a notable 1.2% jump.

- The week did witness a setback for Dow component Nike, which saw a nearly 12% drop after revising its sales outlook. Nike also announced plans to implement cost-cutting measures totaling around $2 billion over the next three years.

- In terms of economic indicators, the Federal Reserve’s preferred inflation gauge, the core personal consumption expenditures price index for November, came in slightly below expectations. The index rose by 0.1% last month and gained 3.2% from a year ago, aligning closely with economist predictions.

- Greg Bassuk, CEO at AXS Investments, noted, “We believe that today’s PCE data, which the Fed weighs heavily in its review of inflation status, further cemented the downward trajectory of inflation. And we think that’s another catalyst for today’s excitement by investors, that a soft landing seems closer to being assured.”

- The ongoing market rally has witnessed a broadening trend as bond yields decrease and traders anticipate potential rate cuts from the central bank. On Friday, the small-cap Russell 2000 gained 0.8%, rounding out its sixth consecutive positive week.

- Greg Bassuk expressed optimism, stating, “It underscores the breadth and depth of this holiday rally, which we think is going to bode well for investors moving into 2024.”

- As the week concluded, it was announced that the U.S. stock market would be closed on Monday for Christmas.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

yes.??