In a significant turn of events, Tencent, one of China’s tech giants, has encountered a substantial setback in the financial markets.

The company’s market value plummeted by over $43 billion, triggered by the introduction of new online gaming regulations in China. This development has far-reaching implications not only for Tencent but also for the broader landscape of the online gaming industry in the country.

On Friday, Tencent witnessed a staggering loss of approximately $43.5 billion in market value following an unexpected move by China to introduce a fresh set of regulations aimed at curtailing excessive gaming and spending.

The draft guidelines, originating from China’s National Press and Publication Administration, had a profound impact on the Hong Kong-listed shares of major players in the online gaming sector, including Tencent, NetEase, and Bilibili. These companies represent some of the largest online gaming-related entities in the world’s most prominent online gaming market.

Analysts, including Brian Tycangco from Stansberry Research, expressed concerns over the implications of China’s regulatory intervention. Tycangco noted that while the move may be well-intended, it raises uncertainties about the viability of existing business models that heavily rely on incentives and rewards to attract and retain users.

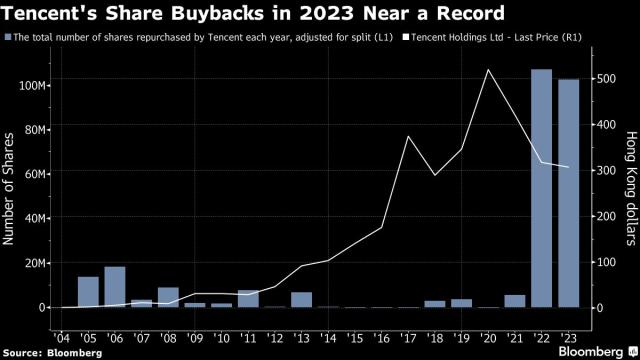

Tencent, headquartered in Shenzhen and known for platforms like WeChat, experienced a significant downturn, with its shares plunging by approximately 12.4% to close at HK$274. This marks the lowest closing level since the end of November 2022.

The latest regulatory measures have sent ripples through the market, prompting a reevaluation of the online gaming industry’s dynamics in China. As Tencent and other major players navigate the impact of these regulations, the broader implications for the industry’s business models and revenue streams remain uncertain, adding a layer of complexity to the landscape of the world’s largest online gaming market.

The company’s market value witnessed a staggering decline of more than $43 billion, signaling investor concerns about the potential impact of regulatory measures on Tencent’s gaming revenue.

- The exact details of the new regulations are crucial to understanding their impact on Tencent. As China seeks to regulate the online gaming industry more tightly, concerns about issues like gaming addiction among the youth and the overall impact on mental health have prompted authorities to implement stricter measures.

- Tencent’s extensive portfolio includes popular online games, and any regulatory changes in the gaming sector have direct repercussions on the company’s revenue streams. The significant drop in market value reflects investor apprehensions about the potential economic consequences of these regulatory shifts.

- The implications extend beyond Tencent, affecting the entire online gaming industry in China. Companies operating in this space will likely face heightened scrutiny and increased regulatory oversight, influencing their operations, revenue models, and growth prospects.

- The market response to Tencent’s market value drop is a testament to the sensitivity of investors to regulatory changes, particularly in industries that have been major contributors to a company’s success. The extent to which Tencent can adapt to and comply with these new regulations will be closely monitored by both investors and industry observers.

NetEase, a company that derived 80% of its third-quarter revenue from domestic online gaming, experienced a sharp decline of 24.6%, closing at HK$122. This downturn resulted in a substantial reduction of approximately HK$115.1 billion ($14.7 billion) in NetEase’s market capitalization during Friday’s trading session.

Bilibili, recognized as a social media platform and relying on Chinese domestic gaming for 17.1% of its total third-quarter net revenue, observed a 9.7% slide in its shares. Closing at HK$80.30, this marked its lowest level since November 2022 and led to a reduction of about HK$2.4 billion ($307 million) in market capitalization.

On the broader market front, the Hang Seng Index concluded Friday with a 1.7% decline, signaling the impact of the regulatory developments. Simultaneously, the China Enterprises Index, representing the largest offshore mainland blue-chip entities listed in Hong Kong, recorded a 2.3% decrease.

Brian Tycangco, an analyst at Stansberry Research, expressed confidence that further clarity on the new rules would emerge in the upcoming days and weeks. However, he acknowledged investor reluctance to wait for uncertainties to settle, emphasizing the potential benefits of improved coordination between industry stakeholders and regulators in the future.

Tencent’s dramatic market value drop underscores the challenges that tech giants face in navigating regulatory landscapes, especially in industries with significant societal impact like online gaming. As the company assesses the implications of these new regulations, the broader tech industry and investors will keenly observe how Tencent adapts to the changing regulatory environment and strives to maintain its standing as a key player in China’s tech ecosystem.