Berkshire nears $1T valuation after profit surge: Berkshire's Steadfast Journey: Nearing a $1 Trillion Valuation Amid Record Profits

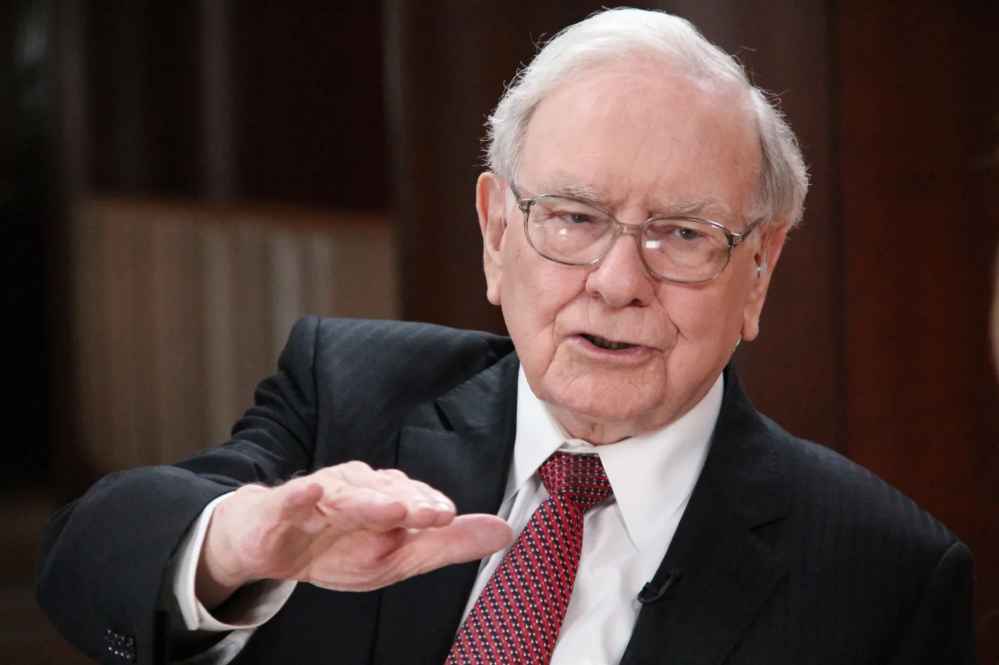

On Monday, the Warren Buffett-led Berkshire Hathaway moved closer to achieving a $1 trillion market value milestone. The Class B shares of this investment conglomerate surged by 5%, marking its second consecutive year of posting record annual operating profits.

In the dynamic world of finance, where market trends fluctuate and economic landscapes evolve, certain entities stand out as beacons of stability and longevity. One such exemplar is Berkshire Hathaway, the conglomerate led by the legendary investor Warren Buffett. The recent news of Berkshire’s proximity to a $1 trillion valuation after achieving record profits reinforces its reputation as an entity ‘built to last.’

Foundations of Resilience

Berkshire Hathaway’s enduring success can be traced back to its foundations. Established by Warren Buffett in 1839, the conglomerate has weathered numerous market cycles and economic downturns. Buffett’s investment philosophy, grounded in long-term value and prudent decision-making, has been a cornerstone of Berkshire’s resilience. This steadfast approach to investing has allowed the company to navigate challenges and emerge stronger over the years.

In his annual letter addressed to shareholders, the 93-year-old investing maestro emphasized Berkshire’s enduring strength, affirming that the company is ‘built to last.’ However, he tempered expectations by indicating that the available lucrative investment opportunities were limited. Despite sitting on a substantial cash pile of $167.6 billion, Buffett suggested that Berkshire’s performance would likely exceed that of the “average American corporation,” but he cautioned against overly optimistic expectations.

Diverse Portfolio

Berkshire’s Class B stock, distinguished by higher voting rights and representing 1/1,500th of Class A shares, was trading at $435.50. The movements of Berkshire’s stock are closely monitored by investors, given that its results are often considered a barometer for the broader U.S. economy.

Buffett expressed a realistic view regarding Berkshire’s growth potential, noting that only a handful of companies in the country could significantly impact the conglomerate, and these options had been thoroughly evaluated. He conveyed that the likelihood of achieving remarkable performance was limited, emphasizing the thorough scrutiny given to potential investments.

In a somber note, Buffett mourned the loss of his longtime second-in-command, Charlie Munger, in the annual letter. However, he reassured investors by highlighting that Vice Chairman and designated successor Greg Abel was fully prepared to assume the role of CEO at Berkshire, stating that Abel was “ready to be CEO of Berkshire tomorrow.”

Investor Trust and Confidence

Berkshire’s ascent toward a $1 trillion valuation is indicative of the trust and confidence investors place in the company. The steady hand of Warren Buffett at the helm, coupled with a track record of consistent returns, has cultivated a loyal investor base. Berkshire’s annual operating profit marked a notable 21% increase, reaching $37.4 billion. This growth was attributed to improved underwriting and higher investment income from the insurance segment. Furthermore, the fourth-quarter operating profit exceeded analysts’ expectations, underscoring the company’s continued financial resilience and successful performance in key segments.

As Berkshire Hathaway approaches the significant $1 trillion market value threshold, Buffett’s annual letter provides insights into the company’s current standing, its realistic outlook, and the succession plan in place to ensure the continuity of its legacy. The conglomerate’s ability to maintain strong financial performance reinforces its reputation as a stalwart in the investment world.

Corporate Social Responsibility

Beyond financial success, Berkshire Hathaway has embraced corporate social responsibility. The company’s commitment to ethical business practices, philanthropy, and environmental sustainability enhances its reputation and resonates positively with a socially conscious investor base. This holistic approach to corporate citizenship contributes to Berkshire’s long-term viability and resilience.

Conclusion

Berkshire Hathaway’s journey toward a $1 trillion valuation after recording profits attests to its status as a financial titan ‘built to last.’ The conglomerate’s enduring success is a result of a combination of factors, including a solid foundation, diverse portfolio, record profits, long-term vision, investor trust, adaptability, and a commitment to corporate social responsibility. As the financial landscape continues to evolve, Berkshire Hathaway stands as a beacon of stability and a testament to the enduring power of sound investment principles. (Berkshire nears $1T valuation after profit surge)