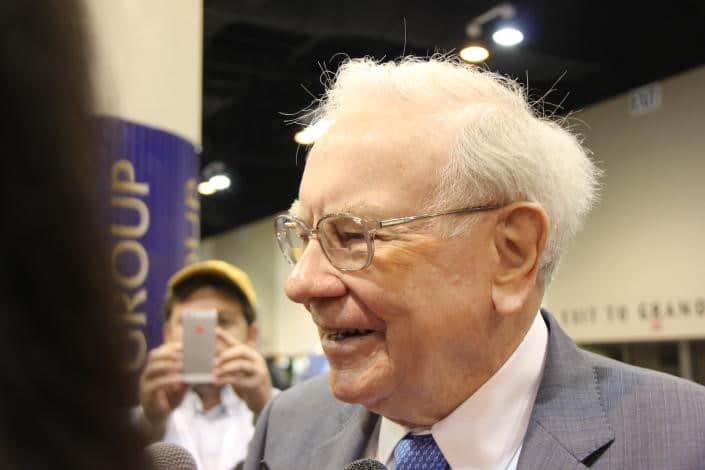

Warren Buffett’s investment strategy at Berkshire Hathaway typically steers clear of the hottest growth stocks, focusing instead on companies with attractive valuations and strong underlying business models within his circle of competence. However, within his extensive portfolio, there exists a group of seven stocks, affectionately known as the “Magnificent Seven,” in which Buffett has invested a substantial $177 billion.

The standout among these seven is undeniably Apple (NASDAQ: AAPL), holding the largest position in Berkshire’s portfolio with a staggering worth of nearly $175.9 billion. Initially, another Berkshire investment manager acquired Magnificent Seven 10 million shares of Apple in May 2016, with Buffett later recognizing the potential and joining the Apple bandwagon. This move proved to be lucrative, with Apple’s shares surging over eightfold since Berkshire’s initial purchase, boasting a remarkable 30% gain in the last 12 months.

The Magnificent Seven narrows down to the “Magnificent Two” as far as Buffett is concerned. It’s also probably fair to say that he views one of those two stocks as much more magnificent than the other.

Amazon (NASDAQ: AMZN) is the sole other Magnificent Seven stock in Berkshire Hathaway’s holdings. Similar to Apple, an investment manager at Berkshire initiated the position in Amazon. Buffett, albeit acknowledging his tardiness in recognizing the company’s potential, now holds a stake worth approximately $1.6 billion. Amazon’s stock has experienced a meteoric rise of nearly 60% in the past 12 months alone.

Meanwhile, Amazon continues to deliver tremendous earnings growth. The company’s streamlining efforts are paying off. I predict that we’ll see more evidence of this in the coming quarters as Amazon’s profitability and free cash flow increase further.

While both Apple and Amazon stand as pillars in Berkshire’s Magnificent Seven, analysts seem more bullish on Amazon’s future prospects. Despite the undeniable appeal of Apple’s iPhone ecosystem, the stock’s forward earnings multiple of 29x raises expectations for robust growth that it’s currently not delivering. Magnificent Seven On the contrary, Amazon continues to exhibit impressive earnings growth, with ongoing streamlining efforts contributing to increased profitability and free cash flow. The rising adoption of artificial intelligence, particularly generative AI, positions Amazon Web Services as a prime beneficiary, ensuring a clear catalyst for both short and long-term gains.

Even though Buffett was late to the party with Amazon, he’s had plenty to celebrate. Over the last 12 months alone, the stock has skyrocketed nearly 60%.

Moreover, the resilience displayed by the U.S. economy bodes well for Amazon’s e-commerce business in 2024. As the leader in the cloud services market, Amazon’s dominance appears secure, making it a compelling choice for investors eyeing substantial returns.

While Apple and Amazon take the spotlight in Berkshire’s Magnificent Seven, it’s worth noting that Buffett’s empire includes two other members of this elite group. Berkshire’s subsidiary, New England Asset Management (NEAM), manages a separate portfolio that includes a stake in Apple, along with holdings in Google parent Alphabet and Microsoft. Berkshire’s subsidiary, New England Asset Management (NEAM), has a separate portfolio. Like Berkshire, NEAM has a stake in Apple. It also owns shares of Google parent Alphabet and Microsoft.

The U.S. economy appears to be demonstrating more resilience than many expected as well. That bodes well for Amazon’s e-commerce business in 2024.

Conclusion

The possibility of these additional Magnificent Seven stocks finding their way into Berkshire’s primary portfolio remains open. Buffett has previously expressed admiration for Google and Microsoft, hinting at the potential for inclusion in the future. Valuations currently pose a challenge, but it wouldn’t be surprising if Buffett or one of his team members decides to add Alphabet and/or Microsoft to the portfolio, further expanding the realm of the Magnificent Seven.